Grain Market Commentary

Wednesday, May 26, 2021

by Jacob Christy, Senior Merchant, The Andersons

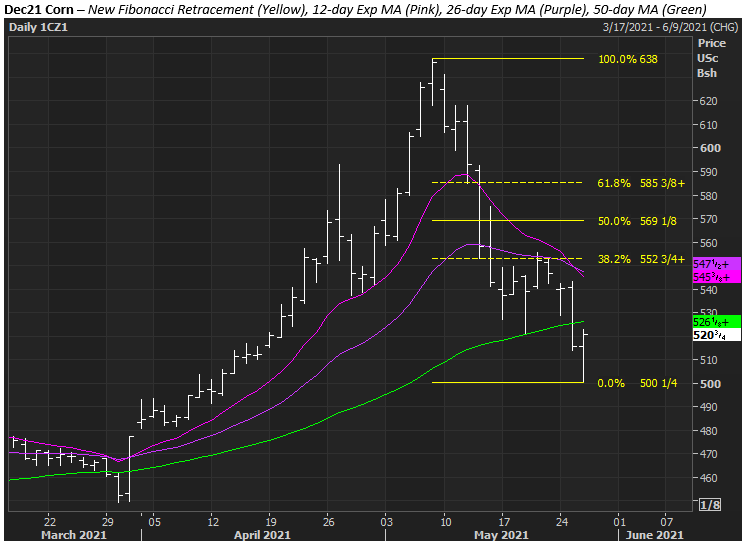

Corn saw a nice upside reversal today after what’s been a terrible two and a half weeks of declines. Prices started the U.S. session sharply on the defensive seeing double digit losses push the new crop contract to its lowest level since April 12th. However, buying interest surfaced once Dec21 closed in on the 500 dollar mark. That buying remained steady throughout the session causing the contract to close the day higher and score the reversal.

From here corn futures will try to use today’s reversal momentum to claw back into the main Fibonacci band from 552-585. The recent selloff has left the market deeply oversold which could help spring a recovery effort. That said, there’s work to do before bull forces are reengaged and trade believes today’s action is anything more than a correction. Look for the recently broken moving averages, starting with the 50-day at 526, to act as initial resistance.

Looking at the corn chart shows a violent market. Prices rallied a historic 79c in the first week of May, only to fall a historic $1.37 in the weeks that followed. Today’s reversal could mark the contracts short term range bounds have been set at 500 and 600. Expect the market to respect this range until the all-important June 30th stocks and acreage reports, with weather and money flow dictating things day-to-day. Stay tuned.

May 27, 2021 at 04:00AM

https://ift.tt/3fnlCV1

Corn Tech Update - May 26, 2021 - The Andersons Trade Group - andersonsgrain.com

https://ift.tt/3gguREe

Corn

No comments:

Post a Comment