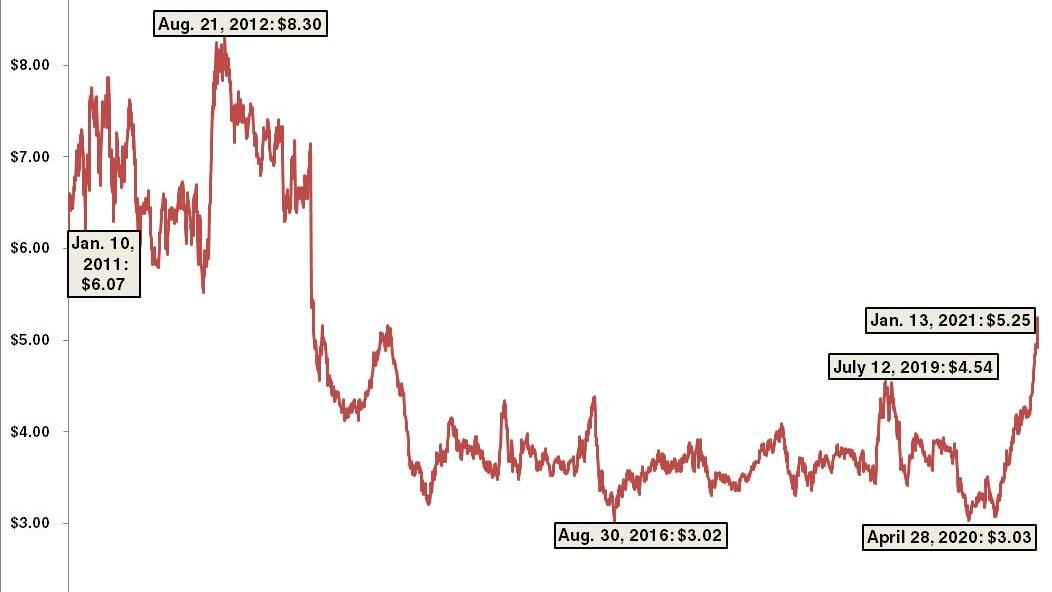

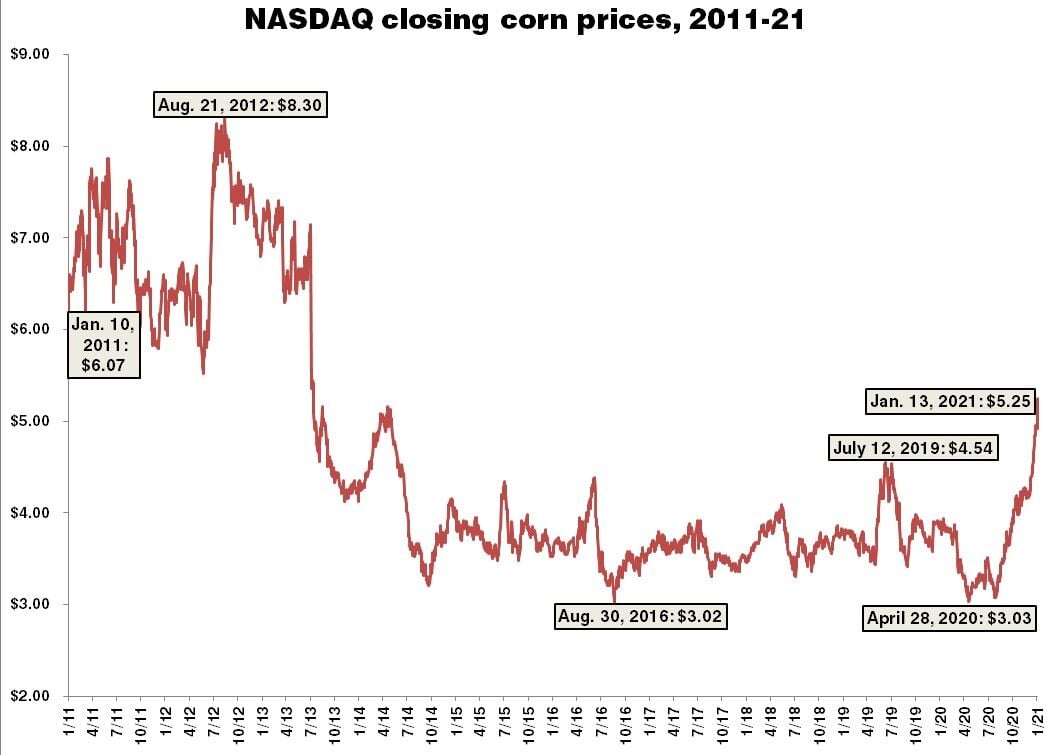

The chart above shows the pattern of daily closing NASDAQ per-bushel corn futures prices over the past 10 years. The decade’s all-time high of $8.30 per bushel coincided with the drought year of 2012, when North Platte recorded its second-lowest annual precipitation of 10.04 inches. The most recent low of $3.08 per bushel was recorded about six weeks into the COVID-19 pandemic in Nebraska. The Jan. 13 closing price of $5.25 per bushel beat the most recent highs of just over $5 on several days in April 2014.

Something unexpected happened for corn growers after COVID-19 set in: Prices have risen to their highest levels in seven years.

Don’t get too excited, cautions a University of Nebraska-Lincoln agricultural economist. And definitely don’t go rent another field for corn just because of it.

“It’s not that we need our sales to be the highest price,” said Cory Walters, a UNL associate professor of agricultural economics. “We need the average price of all our sales to give us the most reasonable profit you can get going into next year.”

He said that doesn’t mean Nebraska farmers with corn in their bins shouldn’t consider selling some now, given that Wednesday’s closing NASDAQ futures price of $5.25 a bushel was that market’s highest since April 2014.

But with the entire 2021 crop year ahead of them, Walters said, producers should keep their focus on building themselves a solid average sales price covering all 12 months of the market year.

Producers aiming for that goal who sell now will do so hoping “that’s your worst sale of the year,” he said.

Walters, who has his own farm besides teaching agricultural economics in the classroom, said he doesn’t pay much attention to annual crop forecasts because of the uncertainty every year brings.

For what it’s worth, then: The U.S. Department of Agriculture Thursday cut its 2020-21 corn production forecast from 14.5 billion bushels to 14.2 billion while boosting the crop year’s average price from $4 per bushel to $4.20.

U.S. farmers still are expected to export a record 2.55 billion bushels, but that’s down 100 million bushels from December’s forecast due to tighter supplies, USDA said in its monthly Feed Outlook report.

With Chinese corn use and imports growing while other nations’ production are dropping, “the imbalance created by these developments is pushing world corn prices ... up sharply from just half a year ago,” the report’s authors said.

That’s the best news in years for Nebraska corn farmers, no matter how fleeting it might or might not be.

NASDAQ’s closing futures price was $3.03 a bushel last April 28, just a penny above the August 2016 bottom of $3.02 after a mostly steady four-year decline.

The nationwide securities market peaked at $8.30 a bushel on Aug. 21, 2012, in the midst of an extended Midwest drought that brought North Platte its second-driest year — with only 10.04 inches of precipitation — since full-year records first were kept there in 1875.

The past six months have seen China greatly increase its corn imports for livestock feed, USDA says. That’s helped to tighten a supply market facing reduced demand for ethanol due to COVID-19 curbs in automobile travel.

Another bright side, Walters said, can be seen in corn production cost trends that are as favorable as they’ve been in several years.

“Buckle up, because we’re well above the cost of production” at present, he said. “That’s a good place to start the new year.”

Still, farmers can’t afford with corn or any other crop to fall for the historic temptation to overproduce that accompanies higher prices, Walters said.

Giving in to that means “you’re going to see more acres planted, which is going to push prices right back down,” he said.

Renting another field, for example, can cost more when the intended crop’s sale prices are up. Such a farmer can see profit margins thin out both from the higher rent and price-depressing bumper crops.

Even worse, Walters said, hailstorms or other weather extremes can come along at any time and wreck a farmer’s expectations for that crop year.

“What if someone had a storm and doesn’t have a crop to sell?” he said. Crop forecasts “cannot foresee financially devastating events.”

While the upturn in corn prices since mid-2020 is encouraging, Walters said, farmers with decent stocks in storage probably shouldn’t sell more than 20% of it at this time.

When corn producers move to sell the rest of their 2020 crop — and thus make room for 2021’s harvest — then should depend on what unfolds over the coming months.

“Commodity prices can move in any direction that active buyers and sellers can move it,” Walters said.

“It’s an auction process. Knowing that, there’s always a chance that unexpected things can happen.”

January 17, 2021 at 04:00PM

https://ift.tt/3qqleaY

In an unexpected turn, corn prices hit 7-year high - North Platte Telegraph

https://ift.tt/3gguREe

Corn

No comments:

Post a Comment