In our last blog post, we asked the question, "Do surging soybeans indicate a sea change in commodities?" The answer appears to be "yes." Soybeans surged as high as $9.66 per bushel in overnight trading Sunday, hitting our $960 per bushel target. Other commodities like natural gas and coffee have popped nicely since then as well. We believe corn could be the next commodity to pop, following soybeans.

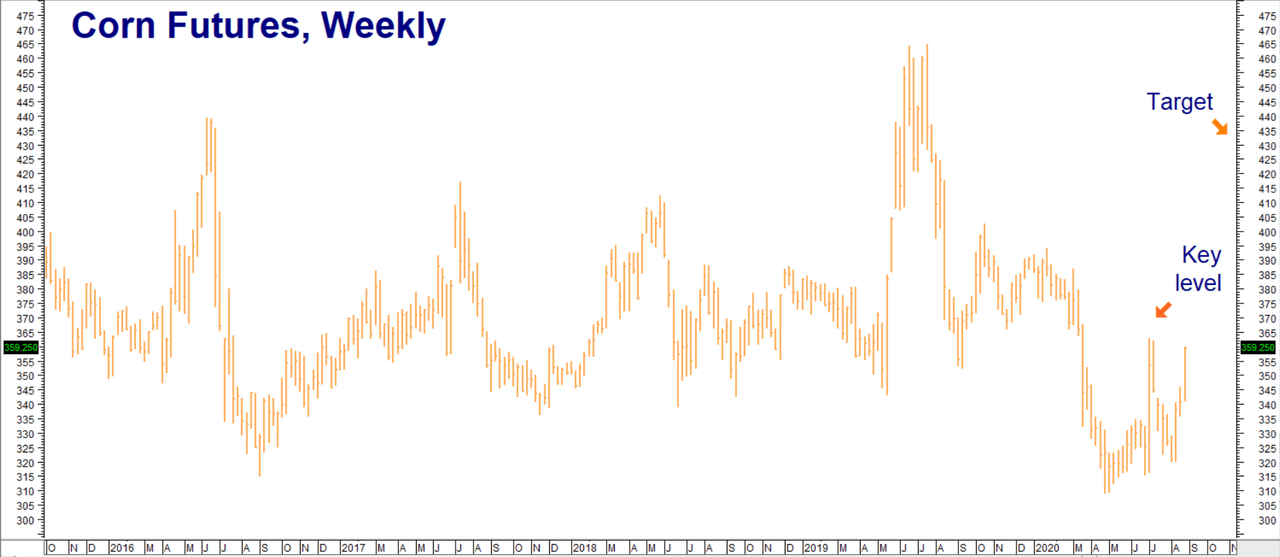

We typically wouldn't look at long position in corn at this point in the crop year because the expectation of increased supplies tends to pressure prices into the fall harvest. Like soybeans, corn is rallying despite an extremely bearish World Supply & Demand report by the US Department of Agriculture (USDA) earlier this month, showing increased supplies and ample stockpiles. This kind of price action often signals the end of a bear market and the start of something else.

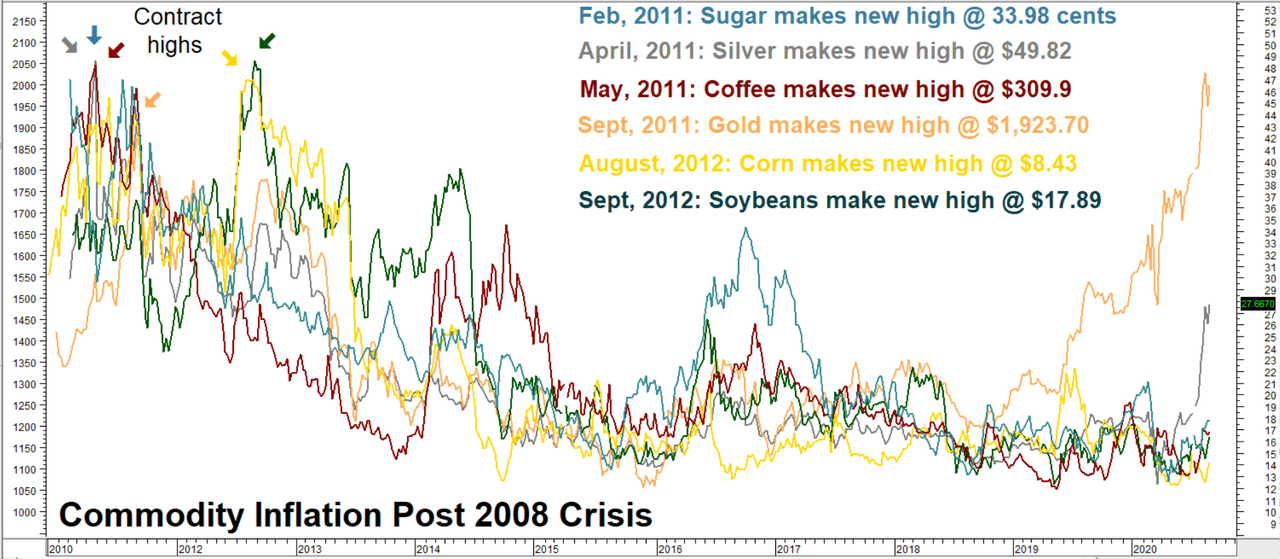

We explored what that "something else" may be in our last blog post. Combine trillions of dollars of Fiscal stimulus with the stated intention of the Federal Reserve to backstop virtually every financial asset known to man and you get the perfect recipe for inflation. The stock market is already discounting this. So have gold and silver. We believe agricultural commodities could be next.

Data Source: Reuters/Datastream

This quote from our August 19 blog post sums up our thinking:

"Silver and gold are the strongest commodities on the board right now. And while we expect them to head much higher pre-election, neither is cheap anymore… Real "bargains" will need to be found elsewhere - in lagging agricultural markets like, sugar, corn, coffee and, yes, soybeans. Agricultural commodities could mimic metals and soar - especially if the current downward trickle of the dollar turns into a torrent, lifting all boats in the process."

The chart above shows what happened to a number of key commodities following the Great Recession of 2008/2009. The Fed responded to that crisis with unprecedented vigor, creating helicopter loads of new money. Their response to this crisis is far greater. Instead of helicopters, Jerome Powell and Company are dropping money from B-52s. We believe the results will be the same - a weaker dollar and commodity price inflation.

Data Source: Reuters/Datastream

Corn should be weak heading into harvest, but it is less than 10 cents away from July's swing high of $3.63 per pound instead. Something is going on. A couple of solid closes above this level could set the stage for a counter-seasonal pop to $4.35 per bushel target. With 81 days left until expiration, the December 2020, close-to-the-money $3.60 corn calls are reasonably priced, offered at $650 each as we write this.

RMB Group trading customers may want to consider picking some up at these levels. Your maximum risk is the amount you spend plus transaction costs. December $3.60 corn calls will be worth at least $3,750 should the December futures contract hit our $4.35 per bushel target prior to option expiration on November 20, 2020.

Holders of the November $9.00/$9.60 bull call spreads we suggested in our May, "Beans Still a Bargain" blog post should exit all positions immediately if you haven't already. Our target has been hit. Continue to hold the July 2021 $9.80/$10.60 bull spreads we suggested purchasing for $675 or less on August 19.

Visit RMB Group to learn more.

This material has been prepared by a sales or trading employee or agent of R.J. O'Brien & Associates ("RJO")/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

September 03, 2020 at 01:41AM

https://ift.tt/34Z0EHl

Soybeans Hit Target, And Surprise Low-Cost Play In Corn - Seeking Alpha

https://ift.tt/3gguREe

Corn

No comments:

Post a Comment