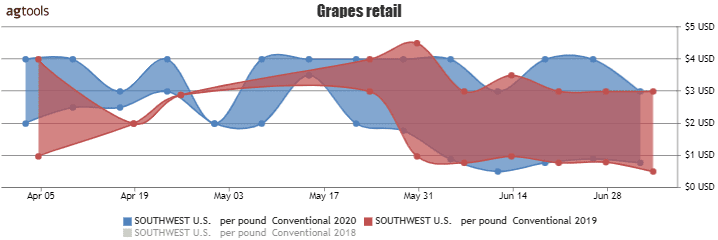

Grape prices are relatively low as supplies transition from Mexico to California.

Retail demand has been weak so far this summer as scan data shows grape sales about 10 percent below last year in June.

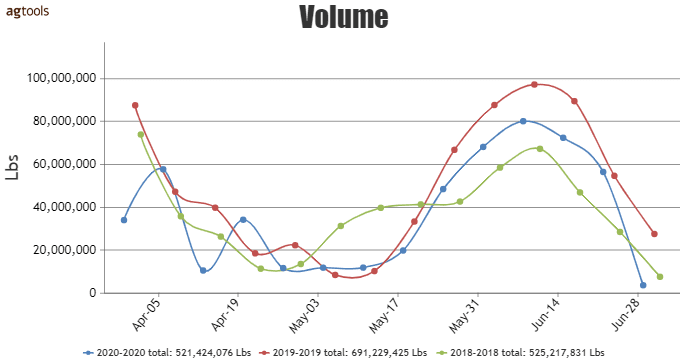

TOTAL VOLUME 3 YEAR COMPARISION

Even though the 2020 volume is lower than in 2019, it is almost the same as 2018, said Raul Lopez, an agronomist with Agtools Inc.

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

In the second half of May, the volume ramped up as the Mexican season started. Similar to the previous two years, this season in 2020 declines at the end of June.

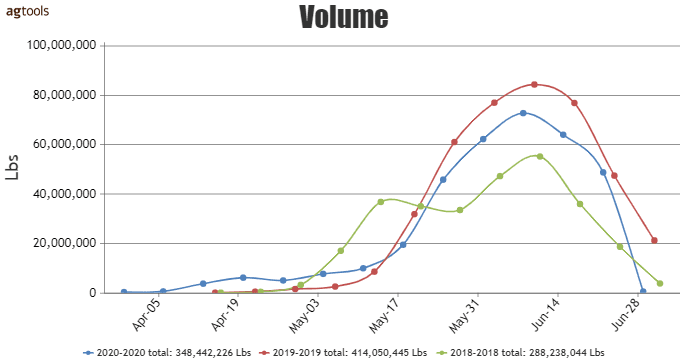

MEXICO SEASON COMPARISON OF 3 YEARS

The Mexican grape season is about to end showing the same behavior as in the previous years. 2020 will end with a drop almost of 16 percent compared to the 2019, however it is a lot better than in 2018, Lopez said. Volume in 2020 is over 20 percent more than in 2018.

VOLUME BY REGION DURING THE SUMMER IN 2019

As we went into May and early June, we can see the Mexico production in blue above, Lopez said. There is also some Southern California production in early June, and in a few days, we will see Central California volume ramp up and continue to be the main supplier for the rest of the summer and fall.

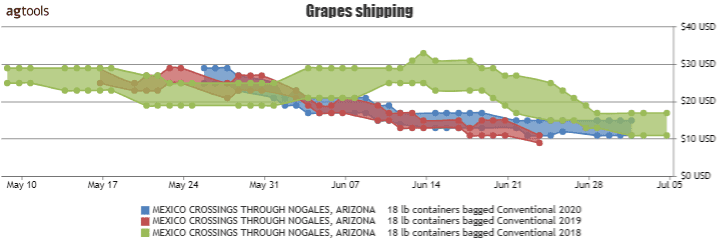

F.O.B. NOGALES AZ. PRICES FOR CONVENTIONAL FLAME SEEDLESS GRAPES FROM MEXICO, 3 YEAR COMPARISON

Prices for Flame seedless grapes are very affordable, he said. As a consequence of the volume available, 2020 is a little higher than 2019 and cheaper than 2018. In June, these prices have been very steady in the $11-16 range.

F.O.B. NOGALES AZ. PRICES FOR CONVENTIONAL SUGARONE GRAPES FROM MEXICO, 3 YEAR COMPARISON

In the case of the sugarone variety, F.O.B. prices also been very steady all season, Lopez said. There is no expected price changes for the Mexican production for the rest of the season.

RETAIL PRICE FOR WHITE SEEDLESS GRAPES

Retail price is the Southwest region in April presented high-lows maybe caused by the lockdowns. In May there has been a range of $1-4 dollars per pound. A little higher than 2019, Lopez said. The California harvest may increase promotional activity and this range may vary over the coming weeks.

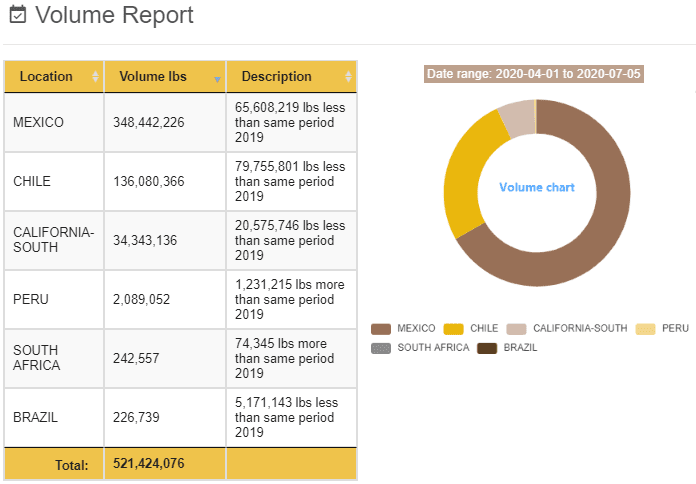

2020 volume in the grape market from April 1st through July 5th has dropped 24 percent compared to 2019. As the Chilean supply has diminished, Mexico holds 66 percent of the market, Chile has 26 percent and the rest is mainly from Southern California and Peru.

The Link LonkJuly 08, 2020 at 03:44AM

https://ift.tt/3f8rBur

Low demand drives down grape market - Produce Blue Book

https://ift.tt/3eO3jWb

Grape

No comments:

Post a Comment